Disclaimer: This article provides knowledge to readers which does not provide any advices to readers. The writer and the company of this article take no legal responsibilities for any usage of these methods. The readers should consult their financial adviser first before implementing any financial decisions.

Investment refers to an act which excess money is placed in a money-generating place to receive incomes or increased value in the future. In other words, investment lets money work to generate more money.

There are numerous types of investments in the market. Some of them prefer secured investments while there are people prefer risky investments. These are investment categories rated from low to high in terms of risk.

- Fixed deposits and government bonds

- Company bonds or borrowing to businesses

- Asset-collated investments (such as gold, real estate and commodities)

- Unit trusts with varied risks depending on their backed investments

- Business available privately or own business

- Shares traded in an exchange

- Exchange-traded funds (ETFs)

- Derivatives trading (such as forward, futures and options)

Besides categorisation of investment risk, there are also investments which are

- actively managed – refers to investors keep an eye on their investments

- passively managed – refers to investors keep their investment aside without viewing their performance actively

Management of investment depends highly on the types of investments made by the investors. Investment is not as easy as you think of putting money in a money-generating vehicle.

Some of you may not want to invest your money for its complication. However, not investing brings more threats than benefits. Continue reading to give a reason to invest for yourself.

1. Combat inflation and deflation risk

Everyone feels the pain of having their favourite items increase their prices. The increase in price can be from various sources, such as increase in price of raw materials, increase in salary of workers and increase in cost of goods sold.

While we are complaining the inflation rate is high, investment can provide reasonable returns which can easily more than the inflation rate. With a balanced investment of 5% in return, we can reduce the impact of inflation of 2% to 3% per annum.

Usually, deflation risk implies reduction of goods price. However, deflation happens when the market downturns. Despite some of the investment may involve losses, having a decent investment can bring better purchasing power during economic downturn.

Invest now based on your risk preference and stop complaining about rising price.

2. Earn better income without putting efforts

Everyone can only use a maximum of 24 hours per day. We can neither utilise all the time for work nor compromise the living needs such as eating and rest. Investment, however, beats all odds by providing income for us even if we could not work.

Imagine if you have a vacant house which had been rented out to a tenant. You may have your total income added by the rental income every month. Even if you are unable to work, the rental income will compensate part of your monthly expenses.

Take note that not all investments are providing incomes. Besides real estate investments which provide such incomes, decent amount of bonds (except zero-coupon bonds), some unit trust schemes, shares and businesses in profit can provide such incomes.

3. Create more wealth unintentionally

We may work the wealth out, either hard or smart. Investment returns can be in different forms.

- Investment income (for bonds, real estate, shares which provide dividends, business)

- Income is received per period basis. It helps in increasing our income. When this income is not used, it can be used in savings.

- Capital appreciation (for zero-coupon bonds, asset-backed investments, business, unit trust and shares)

- This return will be realised when we sell the investment out. We will see an increase of amount of money after selling the investment.

However, wealth will not necessarily accumulate after you obtain any kind of returns. It is recommended to check your spending habit before you look for types of return to improve your wealth. It is better to have a capital appreciation of returns to accumulate wealth if we are spending out our income.

We will also achieve our financial goals and increase our savings without even realising. Start now or never!

4. Obtain better tax savings

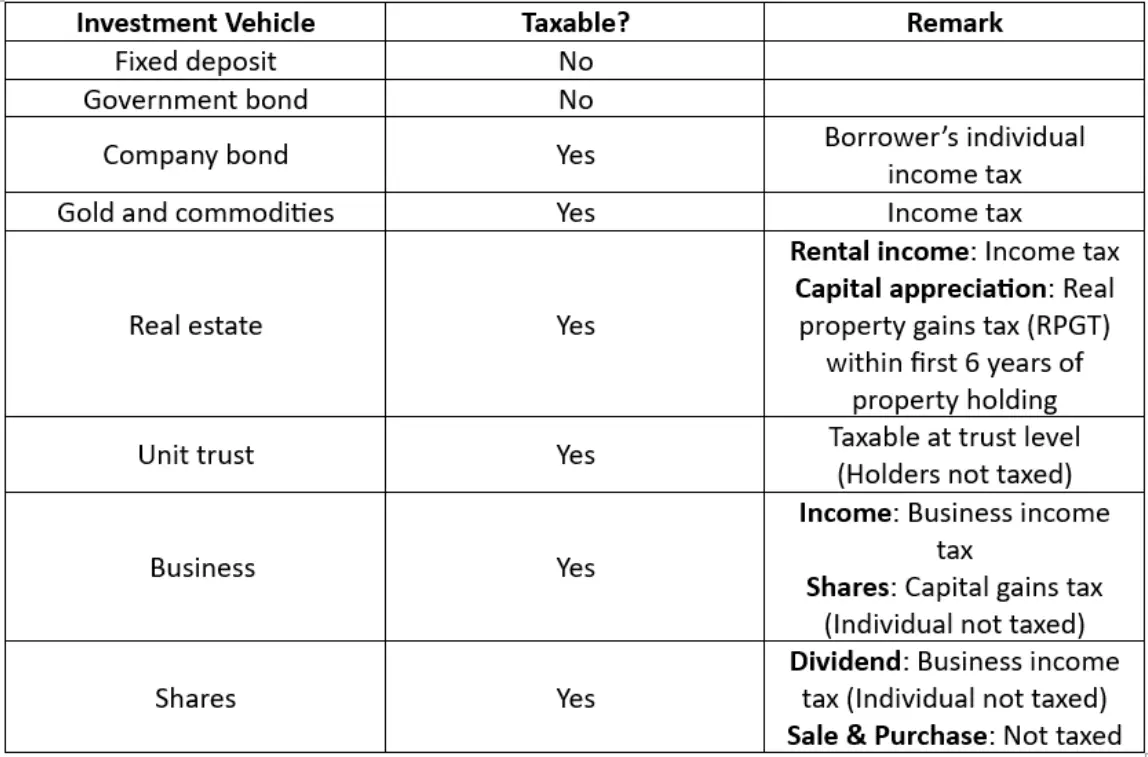

It is a strong point. Not all incomes earned are taxable. Let us look at the legal aspects of taxable investments.

It is attractive that most of the investments by individuals are not taxed. Get your chance now to manage your taxation better!

5. Contribution to the economy and financial resilience of the country

The term “unity is strength” truly behaves in the economy. When people start spending in a specific economy, the company will earn better income which subsequently increases the government tax. Similarly, this applies the same when people investing – when investment increases, the company equity and liability increase.

The increase in company equity and liability will improve company financial position and assist in company spending and expenditure to develop new products or technology. New products or technology improves competition ability among other businesses.

Nonetheless, investing improves the efficiency of the financial system in the country. When the financial system is efficient, less companies will fall into bankruptcy when companies have more financing options, either through borrowing (bonds) or acquisition (equity).

Plan your finance, or prepare to be financed!

Investments can help you and fail you in many ways!

Do you know the risks of investments when you are financing them?

Do you know investments require proper preparation?

Do you know there are strategies in managing risks in investments?

Join the course "Plan For Your Risk" and "Plan For Your Debts" by Minda Sfera Sdn Bhd if you are interested in learning goals setting in investments. You will get the course now

at RM216 (Plan For Your Risk) or RM234 (Plan For Your Debts)

through HRD Corp Claimable Course scheme (contact us for more details)

in Kahoot! courses

Contact us for more details