Disclaimer: This article provides knowledge to readers which does not provide any advices to readers. The writer and the company of this article take no legal responsibilities for any usage of these methods. The readers should consult their financial adviser first before implementing any financial decisions.

It is quite usual nowadays that people are plagued with loans. While there are so many types of loans, it does not matter - loans are required to be repaid fully at a specific time.

Loans are part of reasons why some of the people are not having any money left towards the end of the month. Let us solve the loans without having an empty wallet at the end of the month.

In this article, we are going to use real-life example given during the course. (as shown in the image above)

1. Top-to-bottom method

Also known as "top-down" approach, this method refers to largest loan to be cleared before the smaller loans. In the example above, it means to clear based on this order.

Housing loan

Personal loan (using "compound-to-simple" approach)

Vehicle loan

Credit card loan

The downsides of this method are

High amount of initial repayment should be done as largest loan will have large amount of repayments

High cost of borrowing (even if you are paying the largest loan first) because credit card loans are charging way higher than housing loan

- High credit risks as not repaying short-term loans affect your credit the largest than long-term loans

2. Bottom-to-top Approach (The Most Used Method)

Also known as "snowball effect" approach, this method refers to smallest loan to be cleared before the larger loans. In the example above, it means to clear based on this order.

Credit card loan

Vehicle loan (because the interest amount is higher than compounded interest)

Personal loan

Housing loan

The downsides of this method are

Possible default and bankruptcy risks as failure to repay at least the interest charged may cause financial institution to file a demand

High amount on interest charged because larger loans outstanding tend to have higher interest charged, even if being compared with low-outstanding-high-interest-rate loans

- Demotivates borrowers to repay, especially the largest loan because it looks like there is no ending in repaying loans

3. High-cost To Low-cost Approach (Used Together With Other Methods)

This method refers to clearing loans with the highest interest rate first before the lower interest rate loans. In the example above, it means to clear based on this order if there is no other methods combined.

Credit card loan

Vehicle loan (because the interest amount is higher than compounded interest)

Personal loan (this pays later because the balance outstanding amount is lower)

Housing loan

The downsides of this method are

Possible default and bankruptcy risks as failure to repay at least the interest charged may cause financial institution to file a demand

- High amount on interest charged because larger loans outstanding tend to have higher interest charged, even if being compared with low-outstanding-high-interest-rate loans

4. Compound-interest To Simple-interest Approach (Used Together With Method 3 And 1 Or 2)

This method refers to clearing loans with compound interest rate first before the simple interest rate loans. In the example above, it means to clear based on this order if only combines with method 1 and 3.

Credit card loan

Personal loan

Housing loan

Vehicle loan (you are required to pay $3,000 as interest even you have lower balance outstanding)

The downsides of this method are

High credit risks as not repaying vehicle loans affect your credit larger than long-term loans

- Hard to obtain future loans as vehicle loan starts to affect credit ratings

5. Refinancing (Can Combine Any Methods Of Loan Management)

This method refers to asking the bank to change your finance terms (interest rates and repayment periods) by signing a new loan agreement. The pre-requisite of using this loan solving method is that the borrower should have a good credit rating. You can only refinance these items and should follow this possible order, based on the available example.

Housing loan

Personal loan

Vehicle loan (there is a low probability that this loan can refinance)

Making a refinance requires you to be alert on the economic news. The easiest way for you to know when to refinance is when the Central Bank announces a reduction in overnight policy rate (OPR). If you are refinancing this without looking at these indicators, you may find it hard to refinance to a lower rate.

No downsides for this loan management method. However, doing this frequently may cause lower loan approval rate in the future.

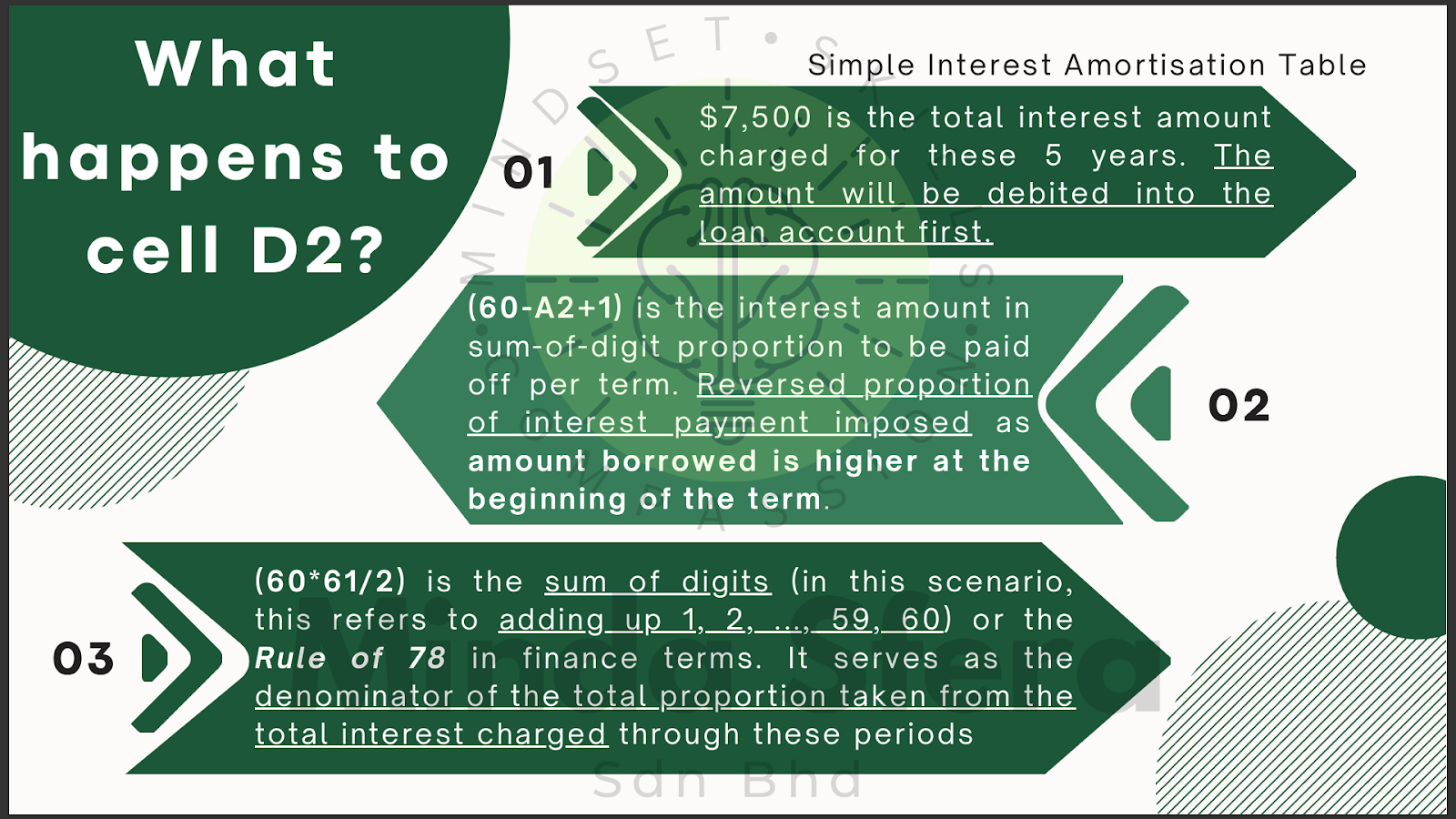

6. Amortisation Table Explanation - Simple Interest

You may check Slide 29 for clearer explanation.

This slide explains a part of a spreadsheet that helps track your simple interest loan payments.

It is about how the interest part of your payment is calculated each month.

How does this work?

The total interest you owe is spread out over the months; in the example, 5 years = 60 months

You pay a bigger chunk of the interest at the beginning and a smaller chunk towards the end.

The slide explains the formula used to figure out how much interest to pay each month, so it is not the same amount every time.

If this is the 52nd payment, then the interest payment for that period will be based on the remaining 9 months (including the current month) from its total interest charged, according to a total portion of the sum from 1 to 60. (7500 X 9 / 1830 = 36.88)

In other words, we should pay 60 parts of interest charged for the first month, 59 parts of interest charged for the second month and so on. This is the reason why we need to have the sum from 1 to 60 in the denominator, with a total portion of 1830; which uses 60 times half of 61.

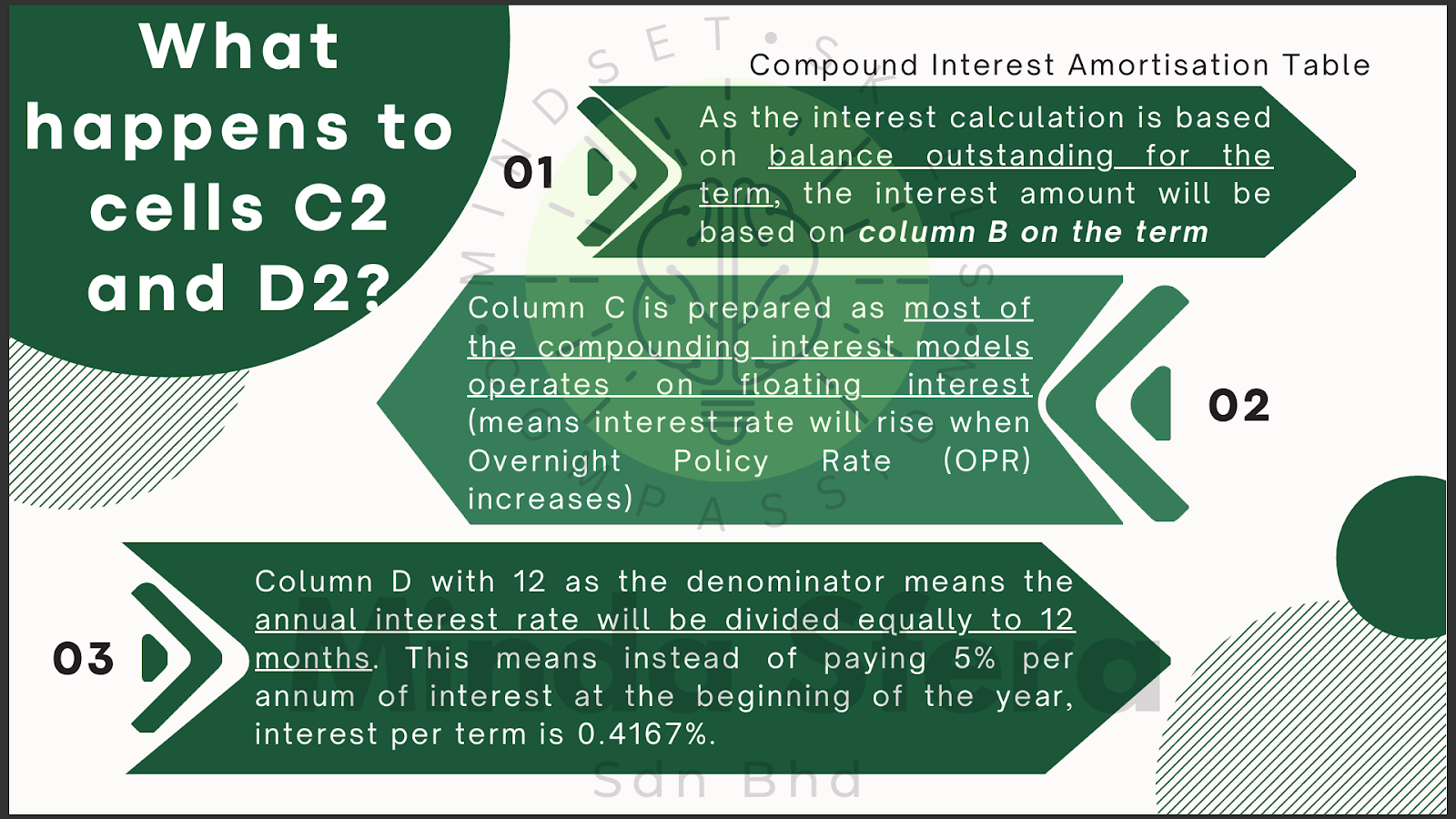

7. Amortisation Table Explanation - Compound Interest

You may check Slide 40 for clearer explanation.

Why does the interest change?

It's because you pay interest on what you still owe. As you pay off the loan, you owe less, so the interest amount changes.

Why divide the interest rate by 12?

Because even though the yearly interest rate is, say, 5%, you pay interest every month. So, the yearly interest is split into 12 months.

Why does the interest rate cell exist?

This is included because sometimes interest rates can change (like with some home loans). The spreadsheet is set up to handle that if it happens.

In A Nutshell - No Method Is Useless, Look For The Best Method For Yourself

Besides solving your loans, check diligently if you require a new loan. A new loan taken means a new obligation, more money required to be set aside before using for your daily expenses.

Check your spending habit. Your spending habit says it all about the best method of loan management.

If you are always motivated after you have completed something, you can use Method 2 (combine with Method 3 and 4)

If you like to solve something difficult first before something that is simpler, you can use Method 1 (combine with Method 3 and 4)

If you are good in credit (you clear all of the outstanding every month), consider Method 5.

If you are planning to obtain a new loan, check your loan margin (maximum 30% to 45% of your annual income) and repay all of your short-term loan outstanding and the interest of the long-term loans (if you could not clear your outstanding)

To better prepare yourself for obtaining a new loan or refinancing, consider enrolling in our "PLAN For Your Debts" course. These programs are designed to equip you with the tools and strategies needed to check your loan and cash flow with confidence. Sign up today and take control of your future!

Join the course "PLAN For Your Debts" and other PLAN Series courses by Minda Sfera Sdn Bhd if you are interested in managing loans and risk fund setting. You will get the course now

through HRD Corp Claimable Course scheme (contact us for more details)

in Kahoot! courses

in Udemy courses

in e-Latih courses

REGISTER OR CONTACT US NOW!